MACD的Python实现

MACD(Moving Average Convergence Divergence)是一种技术分析指标,用于分析股票价格的趋势和动量。在股票交易中,MACD常被用来判断买入和卖出的时机。本文将介绍如何使用Python实现MACD指标的计算和应用。

1. MACD指标的计算公式

MACD指标由两条线组成:快速线(DIF)和慢速线(DEA)。它们的计算公式如下:

- 计算DIF:DIF = EMA(12) – EMA(26)计算DEA:DEA = EMA(DIF,9)计算MACD:MACD = 2 * (DIF – DEA)

其中,EMA为指数移动平均线,计算公式为:EMA(n)= (2 * 当日收盘价 – 前一日EMA)/(n + 1)

2. Python实现MACD指标的计算

下面我们将使用Python实现MACD指标的计算。首先,我们需要导入必要的库:

import pandas as pdimport numpy as np

接下来,我们定义一个函数来计算EMA:

import pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()

然后,我们定义一个函数来计算MACD指标:

import pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()def macd(data, n_fast=12, n_slow=26, n_signal=9): ema_fast = ema(data, n_fast) ema_slow = ema(data, n_slow) dif = ema_fast - ema_slow dea = ema(dif, n_signal) macd = 2 * (dif - dea) return dif, dea, macd

接下来,我们生成一组随机的股票价格数据,并计算MACD指标:

import pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()def macd(data, n_fast=12, n_slow=26, n_signal=9): ema_fast = ema(data, n_fast) ema_slow = ema(data, n_slow) dif = ema_fast - ema_slow dea = ema(dif, n_signal) macd = 2 * (dif - dea) return dif, dea, macdnp.random.seed(42)data = pd.DataFrame(np.random.randint(50, 150, size=100), columns=['Close'])dif, dea, macd = macd(data['Close'])print(dif, dea, macd)

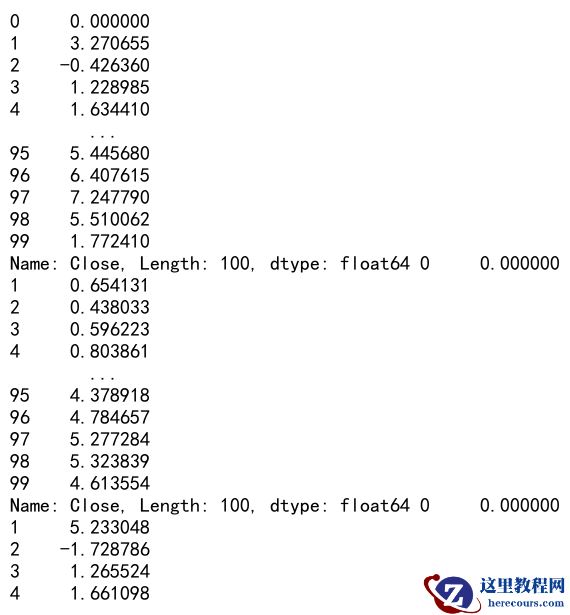

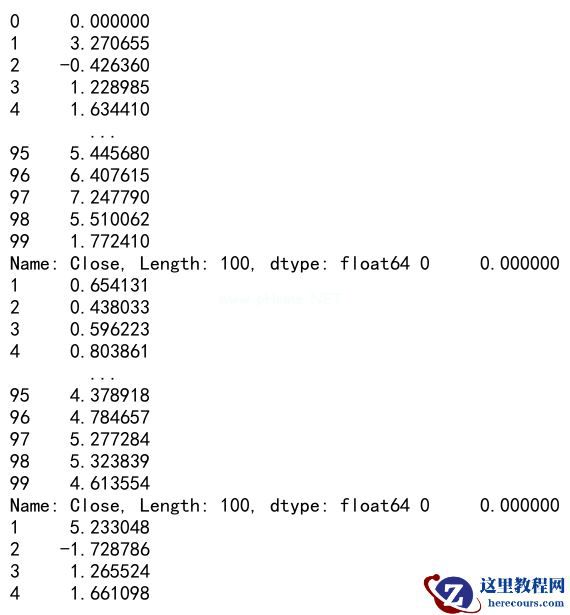

Output:

运行以上代码,我们可以得到MACD指标的计算结果。

3. MACD指标的应用

MACD指标可以用来判断股票价格的趋势和动量,进而指导交易决策。下面我们将介绍几种常见的MACD指标的应用方法。

3.1 金叉和死叉

金叉是指MACD线上穿过DEA线,预示着股票价格可能上涨;死叉是指MACD线下穿过DEA线,预示着股票价格可能下跌。我们可以通过以下代码来判断金叉和死叉:

import pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()def macd(data, n_fast=12, n_slow=26, n_signal=9): ema_fast = ema(data, n_fast) ema_slow = ema(data, n_slow) dif = ema_fast - ema_slow dea = ema(dif, n_signal) macd = 2 * (dif - dea) return dif, dea, macddef golden_cross(macd, signal): return (macd.shift(1) < signal.shift(1)) & (macd > signal)def death_cross(macd, signal): return (macd.shift(1) > signal.shift(1)) & (macd < signal)golden = golden_cross(macd, dea)death = death_cross(macd, dea)print(golden, death)

3.2 MACD柱状图

MACD柱状图是MACD线和DEA线之间的差值,可以用来判断价格的动量。我们可以通过以下代码来绘制MACD柱状图:

import matplotlib.pyplot as pltimport pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()def macd(data, n_fast=12, n_slow=26, n_signal=9): ema_fast = ema(data, n_fast) ema_slow = ema(data, n_slow) dif = ema_fast - ema_slow dea = ema(dif, n_signal) macd = 2 * (dif - dea) return dif, dea, macdplt.figure(figsize=(12, 6))plt.bar(data.index, macd - dea, color='b', alpha=0.7, label='MACD Histogram')plt.legend()plt.show()

3.3 MACD指标的信号

MACD指标的信号可以根据MACD线和DEA线的相对位置来判断。当MACD线在DEA线上方时,表示买入信号;当MACD线在DEA线下方时,表示卖出信号。我们可以通过以下代码来判断信号:

import pandas as pdimport numpy as npdef ema(data, n): return data.ewm(span=n, adjust=False).mean()def macd(data, n_fast=12, n_slow=26, n_signal=9): ema_fast = ema(data, n_fast) ema_slow = ema(data, n_slow) dif = ema_fast - ema_slow dea = ema(dif, n_signal) macd = 2 * (dif - dea) return dif, dea, macddef macd_signal(macd, signal): return np.where(macd > signal, 'Buy', 'Sell')signal = macd_signal(macd, dea)print(signal)